Agrilife24.com: The Bangladesh Bureau of Statistics (BBS) released its Poverty Map of Bangladesh on 30th January 2025. It names Dashar, a small subdistrict in Madaripur, as the poorest area in the country. Alarmingly, over 63% of Dashar's population falls below the upper poverty line.

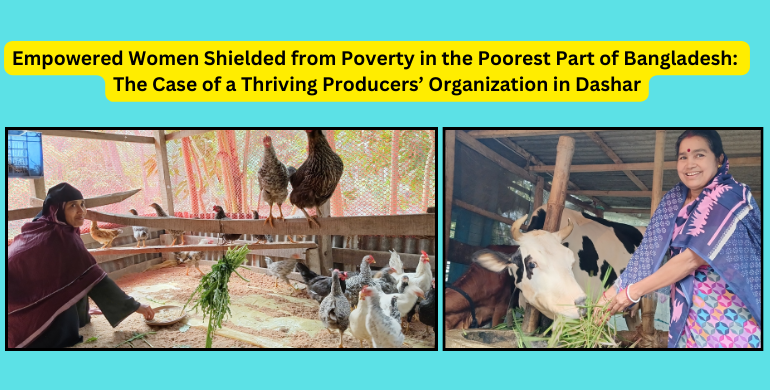

However, despite the intensity of poverty in the area, there is a community that is thriving against the odds. Dashar is home to the Chander Alo Cooperative Credit Union, where for over a decade, women having been working together to ensure their community does not get stuck in the poverty that surrounds them. FAO has had the privilege to work closely with the organization and help them grow into the thriving community that they are today.

Farmers in Dashar face recurring climate-related challenges from seasonal flooding and water shortages to cyclones, siltation and heat waves, making it increasingly difficult for them to prosper. Recognizing the need for sustainable solutions, the Food and Agriculture Organization of the United Nations (FAO), in collaboration with the Ministry of Agriculture (MoA), the Ministry of Fisheries and Livestock (MoFL) and the Sara Bangla Krishak Society (SBKS), a national network of producers’ organizations, has been exploring innovative community-led business models to fight poverty in Dashar and around the country for many years.

As a pilot initiative, FAO Bangladesh chose to work with women-led Chander Alo, originally established in 2002 with facilitation from World Vision Bangladesh and support from the Cooperative Credit Union League of Bangladesh. Around 2014, Chander Alo faced challenges operating its savings and loan programs. To address these challenges, the cooperative sought support from national producers’ organization apex, SBKS in 2015. SBKS and FAO played a pivotal role in strengthening Chander Alo’s operations and fostering its growth.

Under the Missing Middle Initiative project, FAO and SBKS facilitated a comprehensive learning and investment process for rural cooperatives including Chander Alo. With support from the MoA and MoFL and funding from the Global Agriculture and Food Security Program (GAFSP), the initiative focused on building capacity across key areas.

From good governance, financial management and business operations to market access, and digital and technological literacy, the project gave rural institutions the tools to make climate-smart investments and lift themselves out of poverty.

“Organizing, saving, daring and working hard help us to fight poverty,” Chander Alo President, Anjali Boidyo proudly shares. “Over time, we built up our savings and established common facility centres that reduce production costs and ensure fair prices through market linkages. The significant growth in savings, loans, and incomes underscores the vital role of rural women in combating poverty. Together, we are building a resilient and prosperous future.”

FAO also worked with Chander Alo for them to adopt a blended financing model, combining multiple sources: member savings, profits from PO common facility centers, a revolving loan fund established with support from FAO, and bank financing. All these funds came together to ensure that members were able to invest and strengthen their resilience in times of crisis.

“FAO and the Ministry of Agriculture and Ministry of Fisheries and Livestock have been working hand-in-hand with producers’ organizations under this business model for over a decade. The results are evident today, as women from 1,900 households in one of the most poverty-prone upazilas have successfully protected their families from poverty,” shares Jiaoqun Shi, FAO Representative in Bangladesh.

These collaborative models highlight the potential for producer-led cooperatives to not only combat poverty but also empower women and build climate resilience in vulnerable regions.

A final evaluation of the Missing Middle Initiative revealed that PO members' incomes increased by an average of 35%, providing a tangible and distinct shield against poverty in this historically vulnerable area. This demonstrates the transformative power of inclusive, community-driven models that foster financial empowerment and resilience in poverty-prone regions.